Featured

How To Calculate Yield On Property

How To Calculate Yield On Property. Multiply your monthly rental income by 12 to get your annual rental income. It’s the yearly rental income divided by the purchase price.

Multiply that figure by 100 to get your gross rental yield percentage. There are two ways to work out your property yields. To determine the profitability of a rental investment, the simplest calculation to perform is to determine the gross rental yield, by reporting the annual rents received or forecast (excluding charges) in relation to the cost price of the property:

If You're Just Getting Started With Rental Property Management, You Need To Make Sure That You're Getting A Good Amount Of Money Back On Your Investment.

You simply divide the property’s value by 1000, or remove the last three digits. The development yield offers one way to answer this. To calculate rental yield, first know your probable rental income.

To Calculate The Gross Yield Of A Property Is Really Simple.

The value of this property then using the equivalent yield model can be calculated as: Gross rental yield = annual rental income (weekly rent x 52) / purchase price or market value x 100. Yield on cost= net operating income/total project cost.

You Then Times It By 100 To Give You The Percentage.

The yield should be 4.51. That would produce a current yield of 6% (rs 60/rs 1,000). How to calculate gross yield.

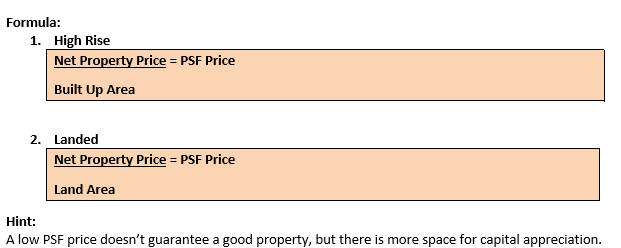

There Are Two Ways To Work Out Your Property Yields.

Annual rent = the total amount of rental income earned in a year. The calculation of the gross return on the rental investment. 6.24% = $15,600 ($300 x 52) / $250,000 x 100.

Divide That Figure By The Property’s Purchase Price.

Rm4,800 x 12 = rm57,600 per annum rental income. Note this is an approximate profit amount because we rounded the initial yield on cost calculation. £4,800 / £70,000 = 0.0686.

Popular Posts

Kane Brown Get Lost On His Own Property

- Get link

- X

- Other Apps

Comments

Post a Comment